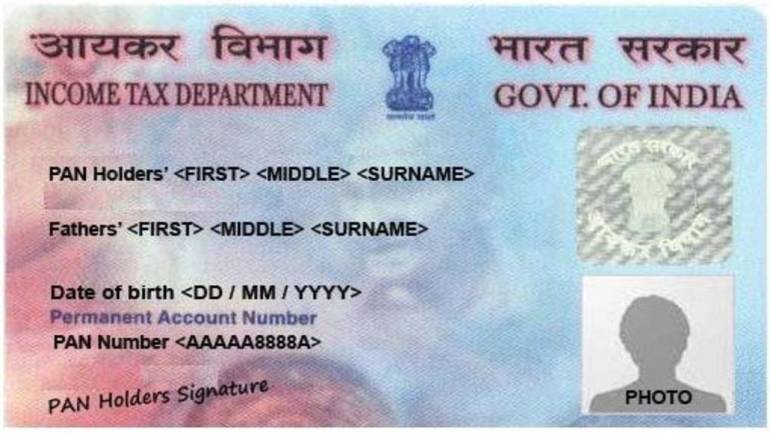

Here's all you need to know about new PAN card rules

PAN Card is one of the most important documents

required for various financial

transactions such as opening a bank account, receiving salary (taxable) etc,

sale or in high-value transactions.

Black Money

has been a talking point in recent times and government is taking all steps to

detect tax evasion. More changes are in offing to PAN card rules to check tax

evasion. These rules will be in effect from 5th December 2018. The

Central Board of Direct Taxes (CBDT) through a notification has amended the

income tax rules.

In exercise of the powers conferred by section 139A read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Boar d of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962,” CBDT circular said

enters into a financial transaction

of Rs 2.5 lakh or more in a financial year, must apply for PAN

Card on or

before the 31st May of next financial year

2) All such resident entities shall have to obtain

PAN even if the total sales/ turnover/ gross

receipts are not above Rs 5 lakh in a financial year. This will help the income tax department

track financial transactions and prevent tax evasion.

receipts are not above Rs 5 lakh in a financial year. This will help the income tax department

track financial transactions and prevent tax evasion.

karta, chief executive officer,

principal officer or office bearer of such entities, who does not

have a

permanent account number, on or before the 31st May, must also immediately

apply for

a PAN card following the financial year in which the person referred

enters into financial

transaction.

4) The new rules don’t concern individual taxpayers who are not associated with entities

4) The new rules don’t concern individual taxpayers who are not associated with entities

mentioned above.

These rules may be called the Income–tax (12th

Amendment) Rules, 2018

The income tax department has also done away

with mandatory quoting of father's name for PAN applications. Income Tax department

said father's name in PAN application forms will not be mandatory in cases

where mother of the applicant is a single parent

About Us:

We are a neo advisory firm that believes in Goal based investment. We offer investment services in Mutual Funds and also retirement/ Life insurance solutions. We have over a decade experience in finance sector. For any clarification / investment needs call us on 9325295502. We provide services across India. Also visit us on www.growwealthadvisors.com

About Us:

We are a neo advisory firm that believes in Goal based investment. We offer investment services in Mutual Funds and also retirement/ Life insurance solutions. We have over a decade experience in finance sector. For any clarification / investment needs call us on 9325295502. We provide services across India. Also visit us on www.growwealthadvisors.com

We are now on Instagram. Visit us on www.instagram.com/growwealthadvisors/

No comments