Saral Jeevan Bima Term Life Insurance

Term insurance also known as

Pure Protection Plan is a life insurance plan offered by an Life insurance

company that provides comprehensive financial coverage in lieu premiums paid till

the end of policy term. This is simplest type of life insurance plan that one

can buy. In a term insurance, policy benefits, also called as death benefits, are

payable in event of death of policyholder. There are no maturity benefits as

there is no saving component in a term life insurance.

Though term plans is supposed to be straight forward plan, at present all insurance companies offer plethora of riders in their term products. These riders include ‘accidental rider’, ‘critical illness rider’ etc. There are plans which offer increasing / decreasing sum assured. Also there are term insurance products with “Return of Premium” option. While all these sounds interesting, in reality common policyholders gets confused between all these and he may not be able to compare life insurance offering from various companies.

Hence, to bring the simplicity and uniformity in the product feature, The Insurance Regulatory and Development Authority of India or IRDA has instructed all the Life Insurance Companies to launch this new Saral Jeevan Bima Term Life Insurance which will be standardize offering for a term insurance

All Life Insurers will have to mandatorily offer the standard product with effect from 1st January 2021.

Let’s look into the features and the benefits of the ‘Saral Jeevan Bima’ Term Life Insurance.

Features

- Saral Life Insurance will be an individual pure risk premium life insurance policy, which will pay a lump sum to the nominee in case of death of policyholder during the term of policy.

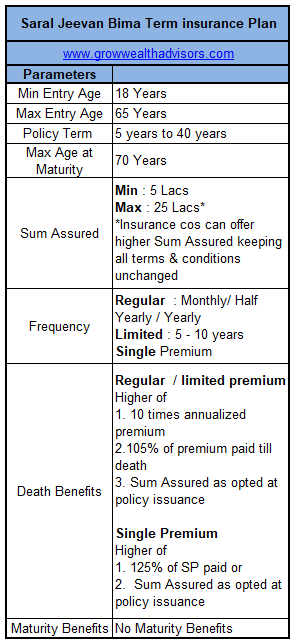

- The minimum entry age will be 18 years and maximum age is 65 years, the duration of the policy will be 5 to 40 years.

- The maximum maturity age is 70 years.

- Life Cover from 5 lakh 25 lakh will be proposed. However, IRDA have allowed insurance companies to offer higher sum assured without any change of conditions.

- The simple life insurance policy will offer three premium payment options, regular premium, limited premium payment period for 5 years and 10 years and single premium.

Policy benefits

Death Benefits

For Single Premium policies:

min 125% of single premium

For regular premium policies:

as per Sum Assured opted (min 5 lacs to max 25 lacs)

Maturity Benefits

Since it is a pure life

insurance plan, there will be no maturity benefit.

Other features

- There will be a waiting period of 45 days from the commencement of the policy. During these 45 days the policy will cover death due to accident only.

- Suicide will not be covered under the policy.

Santosh Aggarwal, Chief Business Officer, Life Insurance, PolicyBazaar.com believes that this scheme will prove to be a boon for first-time buyers of life insurance. Although the premiums may vary, it will have all the features like benefits, inclusion and exclusions as standard for all the insurers.

No comments